The Medicare Annual Election Period Is Underway: Are Your Clients Ready for 2025?

Chris Herman, MSW, LICSW, Senior Practice Associate–Aging

November 2024

The Medicare annual coordinated election period, also known as the open enrollment period (OEP), opened on October 15 and ends on December 7. During this time, people who are already enrolled in Medicare can review, compare, and modify their coverage options. Changes made during the 2024 OEP affect coverage between January 1 and December 31, 2025.

The Medicare OEP differs from the initial enrollment period for people newly eligible for Medicare (Center for Medicare Advocacy, n.d.-a). It is also distinct from the Affordable Care Act (ACA) Health Insurance Marketplace Open Enrollment, which occurs November 1 through December 15 (Centers for Medicare & Medicaid Services [CMS], 2024a; Dorn, 2024); learn about the relationship between the ACA marketplace and Medicare (CMS, 2023).

This publication addresses the following topics:

- why social workers need to understand Medicare open enrollment

- allowable changes during the Medicare OEP

- beneficiary out-of-pocket (OOP) costs associated with various types of Medicare coverage in 2025

- insulin, vaccines, and Extra Help

- free pre-exposure prophylaxis (PrEP) for HIV prevention (new as of late 2024)

- Medicare OEP tools and resources

Please refer to NASW’s 2022 Medicare OEP Practice Alert (Herman, 2022) for information on the following topics:

- overview of Medicare coverage options (including Part A, Part B, Medigap, Part D, and Medicare Advantage)

- financial assistance for Medicare beneficiaries

- messaging regarding Medicare Advantage (MA) and original Medicare

Why Social Workers Need to Understand the Medicare OEP

Medicare is integral to the economic security and health of people with disabilities and older adults. The type (or types) of coverage selected by beneficiaries during the OEP can have profound effects on health care access and cost.

CMS (2024e) encourages beneficiaries to review coverage options each year because the needs of each beneficiary and the coverage available change frequently. Yet, navigating Medicare annual enrollment can be challenging even for long-time beneficiaries and experienced family care partners (also known as family caregivers, with recognition of and respect for whomever a beneficiary considers “family”). Beneficiaries younger than 65 who live with disabilities are more likely to experience difficulty with Medicare enrollment and comparing coverage options, including ascertaining whether they qualify for financial assistance, than beneficiaries 65 years or older (Cubanski et al., 2023). Another analysis found that during the OEP last fall, nearly seven of 10 beneficiaries did not compare their coverage options—and that this proportion was significantly higher among five groups of beneficiaries: (a) people with an annual income of less than $10,000, (b) beneficiaries who identified as Hispanic, (c) beneficiaries 85 years or older, (d) beneficiaries who were dually eligible for Medicare and full Medicaid benefits, and (e) beneficiaries with cognitive impairment (Ochieng et al., 2024). Given that the type(s) of coverage selected by beneficiaries affect health care access and cost, enrollment patterns and decisions can exacerbate health and financial inequities. By providing objective, reliable information about Medicare annual enrollment to beneficiaries, social workers can help mitigate these disparities.

As a social worker, you can mitigate the challenges of annual enrollment and help reduce Medicare-related disparities in multiple ways:

- educating beneficiaries about the significance of the Medicare OEP

- helping beneficiaries to reassess their health needs—such as changes in their medications, health care providers, health condition, and necessary care—each year

- providing unbiased information to beneficiaries about Medicare coverage options and helping beneficiaries consider the implications of each option

- encouraging beneficiaries who are enrolled in Part D prescription drug plans or Medicare Advantage (MA) plans to read two documents, sent by plan sponsors in September, regarding changes forthcoming in 2025: (a) the Annual Notice of Change, or “ANOC” (CMS, n.d.-k; Medicare Rights Center, 2024), and (b) the Evidence of Coverage, or “EOC” (CMS, n.d.-b)

- helping beneficiaries distinguish official Medicare mail, such as ANOCs and EOCs, from MA and Part D marketing ads (CMS, n.d.-q)

- educating beneficiaries about Medicare OEP–related fraud (CMS, 2015)—including marketing rules MA and Part D plans must follow (CMS, 2022; Fletcher, 2023; sample consumer alert: District of Columbia [Department of Insurance, Securities and Banking, 2023])—and referring beneficiaries with concerns to the federally funded Senior Medicare Patrol (SMP, https://smpresource.org/; click “Find Help in Your State”)

- helping beneficiaries navigate the enrollment process

- referring beneficiaries to reliable entities for additional assistance

Allowable Changes During the Medicare OEP

During the OEP, beneficiaries may join a Part D plan, switch from one Part D plan to another, or drop Part D. They may also switch from one MA plan to another, including shifting between plans with or without prescription drug coverage.

The OEP is also a time during which beneficiaries may switch from MA to original Medicare or vice versa. These changes have many implications for beneficiary out-of-pocket (OOP) cost and access to health care providers, as illustrated by an infographic developed by two national nonprofit organizations with which NASW works closely (Center for Medicare Advocacy & National Committee to Preserve Social Security and Medicare, 2019). Moreover, depending on the timing, beneficiaries who switch from MA to original Medicare may not have guaranteed issue rights (Center for Medicare Advocacy, n.d.-b). These rights prevent Medigap plan sponsors from denying purchase of a plan, charging more based on health status, or limiting coverage of pre-existing conditions. (Notwithstanding those rights, Medigap plan sponsors may adjust rates based on other factors, including age, gender, geography, marital status, and smoking habits. Furthermore, Medigap guaranteed issue rights may not apply to Medicare beneficiaries younger than 65 years; please refer, for example, to Kertesz, 2022.)

Beneficiary OOP Costs in 2025

Part A and Part B

Each year, CMS determines standard amounts most beneficiaries will pay for premiums, deductibles, and coinsurance in Part A and Part B. CMS recently released a fact sheet (CMS, 2024m) announcing the following information for 2025.

Part A Deductibles and Coinsurance

- inpatient hospital annual deductible: $1,675 ($44 more than in 2024)

- daily coinsurance for the 61st through 90th inpatient hospital day: $419 (an increase of $11 from 2024)

- coinsurance for each lifetime reserve day in an inpatient hospital: $838 (a $22 increase; each beneficiary’s 60 lifetime reserve days may be split across any hospitalizations that exceed a 90-day benefit period but can only be used one time—a sort of debit model throughout a beneficiary’s lifetime, as explained in Medicare Rights Center, n.d.)

- skilled nursing facility coinsurance: $209.50 (an increase of $5.50)

Part A Premiums

According to the CMS fact sheet, 99 percent of beneficiaries do not pay a monthly premium for Part A because either they or their spouse paid sufficient Medicare taxes while working. CMS (n.d.-a) provides detailed information to help beneficiaries determine whether they qualify for premium-free Part A; as of publication, however, this information had not been updated for 2025. For beneficiaries who do pay premiums, costs will increase by either $7 or by $13 per month (to $285 or $518, respectively), depending on the beneficiary’s work history (CMS, n.d.-m). People who do not qualify for premium-free Part A may also wish to check state or federal marketplaces (https://www.healthcare.gov/get-coverage/) to determine whether they qualify for an ACA subsidy on a non-Medicare plan.

Part B Deductible

The annual deductible for all Medicare Part B beneficiaries will be $257—an increase of $17 from 2024.

Premiums for Full Part B Coverage

The standard Part B premium will be $185.00 per month in 2024, an increase of $10.30 from 2024. According to CMS, this standard premium applies to 92 percent of beneficiaries—specifically, those with a modified adjusted gross income (MAGI) of $106,000 or less for beneficiaries filing individual income taxes and of $212,000 for beneficiaries filing income taxes jointly. Beneficiaries with higher incomes will pay higher monthly premiums, as outlined in the fact sheet; the difference between the standard and higher premiums is known as the income-related monthly adjustment amount, or IRMAA. (For purposes of determining IRMAA, MAGI tiers above the $106,000 threshold vary for any beneficiary who is married and lives with a spouse at any time during the taxable year, but who files tax returns separately from their spouse.)

Premiums for Part B Coverage of Immunosuppressive Drugs

For the third consecutive year, reduced monthly premiums will be available to certain beneficiaries who are no longer eligible for full Medicare coverage because they have had a kidney transplant at least 36 months ago. These beneficiaries can continue Part B coverage solely for immunosuppressive drugs by paying a monthly premium of$110.40 (an increase of $7.40 from 2024). Similar to premiums for full Part B coverage, IRMAA requires beneficiaries in upper-income tiers to pay higher premiums for immunosuppressive drug coverage, as described in the fact sheet; however, the space between the MAGI tiers is smaller than it is for full Part B coverage. Likewise, MAGI tiers beyond $106,000 vary for any beneficiary who is married and lives with a spouse at any time during the taxable year, but who files tax returns separately from their spouse.

Medigap

A high-deductible option (CMS, 2024f) is currently available for three types of Medigap plans in most parts of the United States.

Plan F

The high-deductible version of this plan is available only to people who were newly eligible for Medicare—by virtue of age (65 years or older), disability, or end-stage renal disease—before January 1, 2020.

Plan G

The high-deductible version of this plan is available only to individuals who were (or are) newly eligible for Medicare on or after January 1, 2020.

Plan J

A high-deductible version of this plan is available only to beneficiaries who enrolled in the plan before June 1, 2010. Beneficiaries who were not enrolled in Plan J before that date cannot access either a high-deductible or standard-deductible version of the plan.

Each year, CMS establishes annual high-deductible option amount for Plan F, Plan G, and Plan J. The high-deductible amount for each plan in 2025 will be $2,870, an increase of $70 from the preceding year (CMS, 2024f).

These high-deductible plans may not be available in Massachusetts (CMS, n.d.-g), Minnesota (CMS, n.d.-h), and Wisconsin (CMS, n.d.-i); each of these states authorizes its own standardized plans. Furthermore, although Medigap plans—including high-deductible plans—are available in Puerto Rico, they are not available in American Samoa, Guam, Northern Mariana Islands, or U.S. Virgin Islands (CMS, 2024k).

Medicare Advantage

CMS projects that the average monthly premium for MA plans will be $17.00 per month in 2025 (a $1.23 decrease from the 2024 average monthly premium of $18.23) (CMS, 2024j). CMS has developed fact sheets outlining the MA landscape (availability of plans and average premium costs) for each state and for the District of Columbia and Puerto Rico (CMS, 2024k). MA plans are not available for residents of American Samoa, Guam, Northern Mariana Islands, or U.S. Virgin Islands.

Part D

CMS projects that the average total monthly premium for stand-alone Part D plans will be $40 in 2025, a decrease of $1.63 from 2024 (CMS, 2024c). However, Part D premiums vary greatly and are influenced by multiple factors, such as geography, plan formulary, and plan deductible, copayments, and coinsurance amounts. CMS provides updated fact sheets regarding the Part D landscape for each state and for the District of Columbia, American Samoa, Guam, Northern Mariana Islands, Puerto Rico, and the U.S. Virgin Islands (CMS, 2024k). Each fact sheet provides information regarding the availability of, and average premium costs for, Part D plans in the given state or jurisdiction.

Another significant factor in determining Part D premiums is beneficiary income (CMS, n.d.-j). As a CMS fact sheet delineates, the average basic monthly premium for any Part D plan—regardless of plan features or geographic area—will increase for beneficiaries with an individual or married-filing-separately MAGI of more than $106,000 or a joint MAGI of more than $212,000 (about 8 percent of beneficiaries enrolled in Part D plans) (CMS, n.d.-j). For example, four beneficiaries living in Arkansas select the same Part D plan. Beneficiary 1 has an individual MAGI of $30,000; beneficiary 2 has a joint MAGI of $50,000; beneficiary 3 has an individual MAGI of $125,000; and beneficiary 4 has a joint MAGI of $240,000. Beneficiaries 1 and 2 will pay less for the same plan in Arkansas than beneficiaries 3 and 4.

Part D enrollees will experience improvements to prescription drug coverage in 2025 as a result of the Inflation Reduction Act of 2022 (Pub. L. 117-169).

Annual Spending Cap and Manufacturer Discount Program

Beneficiaries’ maximum OOP cost sharing on Part D–covered prescription drugs will decrease dramatically to $2,000, without a coverage gap, in 2025 and successive years (CMS, 2024i). The benefit has been redesigned with three phases:

-

Annual Deductible

The beneficiary pays the full cost of eligible Part D–covered prescription drugs until the deductible is met. The maximum Part D annual deductible a plan may charge in 2025 will be $590 (an increase of $44 as compared to 2024). Deductibles vary by plan, and some plans cover certain prescription drugs before the beneficiary meets the deductible. (CMS, 2024p)

-

Initial Coverage

After meeting the deductible, the beneficiary pays 25 percent of the cost of most Part D–covered prescription drugs (or up to 33 percent of the cost of specialty tier drugs) until reaching the OOP spending cap of $2,000. (OOP spending excludes monthly premiums but includes all copayments or coinsurance for Part D–covered prescription drugs, including those paid before a beneficiary meets the annual deductible. It also includes some drug costs covered on behalf of a beneficiary, such as through the Part D Extra Help program and Employer Group Waiver Plans.) During the initial coverage period, pharmaceutical manufacturers will provide a discount of 10 percent on certain brand-name drugs, biologics, and biosimilars. (CMS, 2024i)

-

Catastrophic Coverage

After reaching the $2,000 OOP threshold, the beneficiary will not have to pay for covered drugs for the remainder of the year (CMS, 2024b). (Premium payments, if applicable, will continue throughout the year.) This $2,000 OOP spending cap applies to both stand-alone prescription drug plans (those purchased by beneficiaries enrolled in original Medicare) and MA prescription drug plans. During the catastrophic coverage period, manufacturers will provide a discount of 20 percent on certain brand-name drugs, biologics, and biosimilars. (CMS, 2024i).

After reaching the $2,000 OOP threshold, the beneficiary will not have to pay for covered drugs for the remainder of the year (CMS, 2024b). (Premium payments, if applicable, will continue throughout the year.) This $2,000 OOP spending cap applies to both stand-alone prescription drug plans (those purchased by beneficiaries enrolled in original Medicare) and MA prescription drug plans. During the catastrophic coverage period, manufacturers will provide a discount of 20 percent on certain brand-name drugs, biologics, and biosimilars. (CMS, 2024i).

Monthly Prescription Payment Plan

A Medicare Prescription Payment Plan (M3P) will be available to beneficiaries enrolled in any Medicare Part D plan or any other Medicare plan that offers prescription drug coverage (such as an MA plan) (CMS, n.d.-r, 2024o). M3P will enable beneficiaries to divide OOP drug costs into monthly payments, thereby spreading those costs across the year, at no extra cost. Any beneficiary who opts in to M3P will receive monthly bills from their drug plan.

When comparing coverage options using the Medicare Plan Finder (https://www.medicare.gov/plan-compare), beneficiaries and other users may compare estimated prescription drug costs with and without the M3P option. However, each beneficiary must contact their Part D or other health plan directly to sign up for M3P.

Beneficiaries may sign up for M3P during the OEP or any time during 2025; likewise, they may withdraw from M3P at any time. M3P is most likely to help beneficiaries who have high prescription drug costs that are not consistent during the year, especially if those costs are incurred before the month of October.

In 2026 and thereafter, prices for certain high-cost, no-competition drugs covered by Part D and Part B will decrease thanks to Medicare price negotiation (another provision of the Inflation Reduction Act of 2022 (Pub. L. 117-169). Visit https://www.medicare.gov/about-us/prescription-drug-law and https://www.cms.gov/files/document/infographic-negotiated-prices-maximum-fair-prices.pdf for more information about the Medicare Drug Price Negotiation Program.

Insulin, Vaccines, and Extra Help

Additional medication-related changes spurred by the Inflation Reduction Act of 2022 (Pub. L. 117-169) remain in effect for 2025 and successive years.

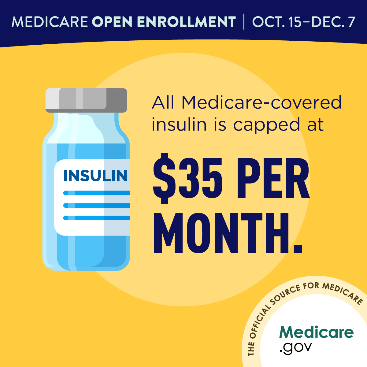

Reduced-Cost Insulin

Beneficiaries who use insulin products that are covered by Medicare will pay no more than $35 per month’s supply of each covered insulin product; moreover, covered insulin products will not be subject to an annual deductible (CMS, n.d.-f). These benefits apply both to beneficiaries who use insulin products covered by their respective Part D plan and to those who use insulin through a traditional (that is, nondisposable) pump covered under Medicare Part B’s durable medical equipment benefit.

Free Vaccines

All vaccines recommended for adults by the federal Advisory Committee on Immunization Practices (ACIP, part of the Centers for Disease Control and Prevention [CDC]; https://www.cdc.gov/acip) will be available to Part D enrollees for free, including during the deductible phase. These include vaccines to prevent the following illnesses:

- respiratory syncytial virus (RSV) (CMS, n.d.-n)

- shingles (CMS, n.d.-o)

- tetanus, diphtheria, and pertussis (whooping cough, commonly known as “Tdap”) (CMS, n.d.-p)

Visit the ACIP page (https://www.cdc.gov/acip/vaccine-recommendations/index.html) for complete information regarding current vaccination recommendations.

Additionally—and unrelated to the Inflation Reduction Act of 2022 (Pub. L. 117-169)—Medicare Part B continues to cover the following preventive vaccines:

- Hepatitis B, if the beneficiary is at medium or high risk (CMS, n.d.-d)

- influenza (flu) (CMS, n.d.-c)

- pneumococcal (pneumonia) (CMS, n.d.-l)

- SARS-CoV-2 (COVID-19)—specifically, the 2024–2025 formulas manufactured by Pfizer–BioNTech, Moderna, and Novavax (CMS, 2024d)

Extra Help for Part D OOP Costs

Any beneficiary who lives in the District of Columbia or one of the 50 states, has an income of less than 150 percent of the federal poverty level (FPL), and meets statutory resource limit requirements is fully eligible for the Medicare Part D Extra Help program, also known as the full Low Income Subsidy (LIS).

Before 2024, the full LIS was available only to beneficiaries with an income of less than 135 percent of the FPL; beneficiaries with an income between 135 and 150 percent of the FPL qualified for partial LIS, which has been eliminated (Justice in Aging, 2022). CMS has estimated that this expansion enabled almost 300,000 Medicare beneficiaries to transition from partial to full LIS between January and mid-September 2024, but that an additional 3 million eligible beneficiaries are not enrolled in the program (Winter, 2024). (As of the date of this publication, the FPL for 2025 has not yet been announced; please monitor https://aspe.hhs.gov/topics/poverty-economic-mobility/poverty-guidelines for an update.)

As a result of the Extra Help expansion, all LIS enrollees pay no Part D deductible or premiums. Moreover, they have reduced cost sharing for prescription drugs when such drugs are purchased in their plan’s participating pharmacies. In 2025, LIS enrollees will pay no more than $4.90 for each generic drug and no more than $12.15 for each brand-name drug. After the catastrophic coverage period is reached, they will have no OOP costs for the remainder of the year. (CMS, n.d.-e).

Please refer to NASW’s 2022 Medicare OEP Practice Alert (Herman, 2022) for information about other types of financial assistance for Medicare beneficiaries.

New as of Late 2024: Free PrEP for HIV Prevention

In the past, Medicare beneficiaries could obtain oral antiretroviral drugs for HIV prevention (PrEP), as approved by the U.S. Food and Drug Administration [FDA], through Medicare Part D. At that time, PrEP was subject to OOP cost sharing (including deductible, if applicable), similar to other prescription drugs. As of September 30, however, many Medicare beneficiaries can obtain PrEP for HIV prevention at no OOP cost, including during the deductible phase: Medicare Part B now covers PrEP and related services if the prescribing physician or other health care provider with prescribing privileges determines a beneficiary has a high risk of acquiring HIV (CMS, 2024n). The practitioner need not specialize in HIV or infectious conditions to prescribe PrEP (CDC, 2022).

Thus, eligible beneficiaries may obtain, free of charge, the following treatments and related services (CMS, n.d.-m, 2024g).

Any FDA-Approved Oral or Injectable PrEP Medication for HIV Prevention

Beneficiaries Enrolled in Original Medicare (Part A and Part B)

If the beneficiary receives the medication in a health care practitioner’s office, the provider must accept Medicare assignment. Visit https://www.medicare.gov/basics/costs/medicare-costs/provider-accept-Medicare to learn the distinctions among practitioners who accept assignment, those who submit claims to Medicare but are nonparticipating providers, and those who opt out of Medicare.

If the beneficiary obtains the medication at a pharmacy, the pharmacy must be enrolled in Medicare and able to submit claims to Part B. If the pharmacy can’t bill Medicare for PrEP, the beneficiary should call Medicare for assistance in finding a qualifying pharmacy. (Contact information is included in the resource list at the end of this publication.)

Beneficiaries Enrolled in an MA Plan

If the beneficiary receives the medication in a health care practitioner’s office or at a pharmacy, the practitioner or the pharmacy must be in the MA plan’s provider network.

If the practitioner or pharmacy is not in the provider network, the beneficiary should contact their MA plan for assistance in finding a qualifying provider or pharmacy.

Related Services

The following services are covered if the prescribing practitioner accepts Medicare assignment (for original Medicare) or is in the beneficiary’s plan network (for MA):

- up to eight individual counseling sessions every 12 months

-

up to eight HIV screenings every 12 months

-

a single screening for Hepatitis B virus

The expanded coverage of PrEP and related services is a significant step toward equity between Medicare and many other forms of health insurance (including most commercial health insurance and Medicaid plans) (CMS, 2024h; HHS, 2024a) and had been supported by NASW (Aging Life Care Association® et al., 2022). An important distinction exists for beneficiaries living with HIV, however: Medicare Part D continues to cover FDA-approved antiretroviral medication as HIV treatments (CMS, 2024g).

Visit https://www.cms.gov/files/document/prep-hiv-prevention.pdf for a beneficiary-oriented fact sheet about Medicare Part B coverage of PrEP for HIV prevention (and coverage of related services).

Enrollment Tools

Medicare & You handbook

CMS sent a print copy of its Medicare & You 2025 handbook (CMS, 2024l) by postal mail to all Medicare beneficiaries (except those who had requested links by e-mail) in September. The 2025 handbook is available in the following languages and formats:

English and Spanish

Formats: eBook (PDF), standard print, large print, audio mp3, audio compact disc, and Braille

Chinese, Korean, and Vietnamese

Formats: PDF and standard print

Arabic, Russian, and Tagalog (new for 2025)

Format: PDF

Visit https://www.medicare.gov/publications/search?keywords=10050 and select the applicable language in the “filter by” option for additional information. The landing page for any given language will include two options: “Open PDF” and “Order Print.” Click “Get More Formats” to discover other formats available in English and Spanish.

Although Medicare & You is updated annually, it includes only basic information regarding Medigap, Part D, and MA plans. CMS encourages beneficiaries to use the handbook for quick comparisons and to seek more thorough information from the following resources.

Medicare Plan Finder

For users who have access to and are comfortable with digital technology, the Medicare Plan Finder (also known simply as “Plan Finder”) may be an appropriate tool for obtaining information about Medicare coverage options. Plan Finder is accessible by direct link (https://www.medicare.gov/plan-compare) or by clicking “Find plans” in the upper left corner of the Medicare home page (https://www.medicare.gov/).

Live Support

Live support from CMS is available 24 hours per day, seven days per week, except on some federal holidays. According to CMS, 10 a.m. to 4 p.m. EST are the busiest hours on any given day, and Mondays and Tuesdays are the busiest days of the week. CMS offers three options for live support.

Telephone

Users who do not have internet access or who wish to talk with a CMS representative can call 1-800-MEDICARE (1-800-633-4227). CMS representatives can converse directly with beneficiaries in English and Spanish, and language line interpretation is available for more than 200 other languages.

Teletypewriter (TTY)

Users can call 1-877-486-2048.

Live Chat

Users can initiate a live chat by clicking the chat icon in the top right corner of any Medicare.gov page, by going to the “Contact Medicare” page (https://www.medicare.gov/talk-to-someone), or by visiting the “Live Chat” page (https://chat.mymedicare.gov/chatclient/chatrequest.aspx).

State Health Insurance Assistance Program

Another resource for Medicare beneficiaries who need live assistance is the federally funded State Health Insurance Assistance Program (SHIP; https://www.shiphelp.org/). SHIP can be especially helpful for the following people:

- beneficiaries with low literacy, including health, financial, or digital literacy

- beneficiaries with end-stage renal disease or other complex health conditions

- beneficiaries with a second type of coverage, including Medicaid

Managed by the federal Administration for Community Living (ACL) and operated in partnership with state offices, local agencies, grantees, and community providers, SHIP provides free, one-on-one counseling, assistance, and education regarding Medicare (ACL, 2024). Unlike private insurance brokers, SHIP counselors do not sell Medicare plans or receive commissions for enrollments. Therefore, SHIP is an unbiased, trustworthy source of information (SHIP Technical Assistance Center, n.d.).

SHIP sites exist in all 50 states, the District of Columbia, Guam, Puerto Rico, and the U.S. Virgin Islands. Availability of virtual and in-person appointments varies based on location and beneficiary need. Appointments tend to fill quickly during the OEP, although SHIPs without available appointments might still be able to help beneficiaries by phone. To find a SHIP site in your state or jurisdiction, visit the SHIP Locator (https://www.shiphelp.org/about-medicare/regional-ship-location) or call 1-877-839-2675.

Resources

CMS Resources

Enrollment Tools

1-800-MEDICARE (1-800-633-4227); TTY: 1-877-486-2048

Medicare Plan Finder: https://www.medicare.gov/plan-compare

Medicare OEP on-demand training

Beneficiary-Oriented Educational and Outreach Materials

-

English

Written materials, videos, social media, and television and radio ads: https://www.cms.gov/outreach-and-education/reach-out/find-tools-to-help-you-help-others/open-enrollment-outreach-and-media-materials

-

Spanish

Written materials, videos, social media, and radio ads: https://www.cms.gov/outreach-and-education/reach-out/find-tools-to-help-you-help-others/open-enrollment-materials-for-spanish-speakers

-

Materials for other audiences

Public-service announcements in 10 Native languages and several English-language written materials for American Indians and Alaska Natives; written materials in Arabic, Chinese, Creole, Khmer, Korean, Polish, Russian, and Vietnamese: https://www.cms.gov/Outreach-and-Education/Reach-Out/Find-tools-to-help-you-help-others/Open-Enrollment-materials-for-other-audiences

Other Federally Funded Resources

State Health Insurance Assistance Program (SHIP)

https://www.shiphelp.org/ (Click “Find Local Medicare Help” in the top right corner of the page or “Find Your Local SHIP” at the bottom right corner of the page) or 1-877-839-2675

Senior Medicare Patrol (SMP)

https://smpresource.org/ (Click “Find Help in Your State”) or 877-808-2468

National, Nonprofit, Beneficiary-Focused Organizations

Social workers and beneficiaries seeking accurate information about Medicare coverage options may also find useful the following free resources from organizations with which NASW works closely.

Center for Medicare Advocacy

Medicare Rights Center

Justice in Aging

National Council on Aging

NASW